Crypto Market Pulse: Stablecoins Take the Wheel—Should You Worry?

Crypto Market Pulse: Stablecoins Take the Wheel—Should You Worry?

🎙️ Welcome back to CryptoCoinToss, where we flip the coin and see if it lands on “bull” or “bear.” Today’s episode: “Stablecoins Are Eating the Market—What Does It Mean?”

Table of Contents

- Let’s Talk Numbers First…

- Bitcoin’s Losing Steam—Is It Profit-Taking or Panic?

- Ethereum Holds Up Better, But It’s Not Leading the Charge

- Altcoin Graveyard—Except for One Token

- The Big Takeaway—What This Means for Your Bags

- Final Question: Cut Your Losses or Ride It Out?

- Why I Recommend Coinbase for Trading

Let’s Talk Numbers First…

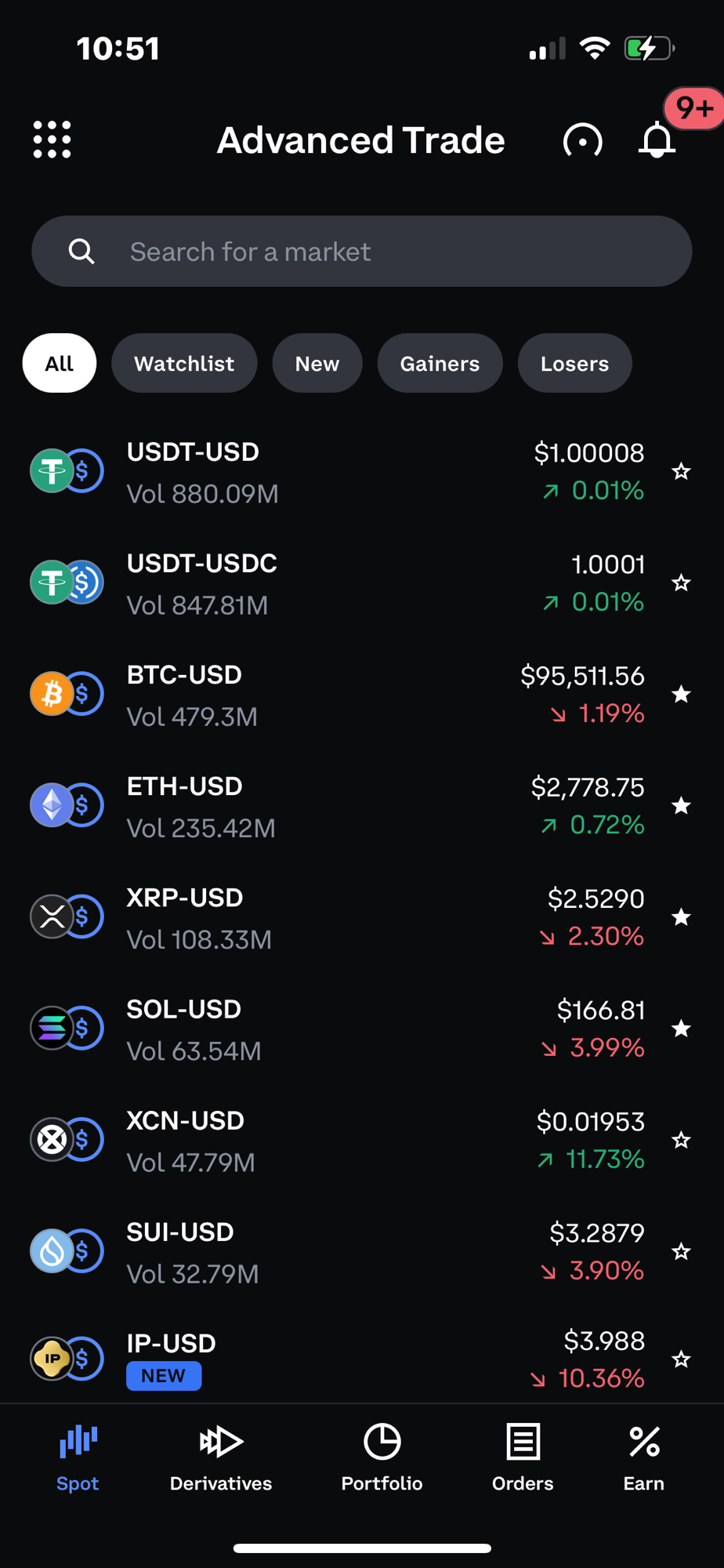

I pulled up the latest market data (Feb 18, 2025), and the first thing that smacked me in the face? USDT is running the show.

- USDT-USD: $880M in volume

- USDT-USDC: $847M in volume

That’s over $1.7 BILLION in stablecoin trading. Compare that to BTC’s $479M and ETH’s $235M, and you see the pattern: People are sitting in stablecoins, waiting.

Bitcoin’s Losing Steam—Is It Profit-Taking or Panic?

Bitcoin’s at $95,511 (-1.19%), which isn’t a catastrophe, but here’s what’s interesting:

- High volume, but price is slipping → This tells me that there’s still trading activity, but more people are selling than buying.

- Not a total dump, but a slow leak → No panic, just hesitation to buy big.

If BTC was flying past $100K, we’d be seeing green volume bars exploding. But instead, we get this meh, sideways action.

Ethereum Holds Up Better, But It’s Not Leading the Charge

ETH is chilling at $2,778.75 (+0.72%), slightly in the green. It’s not dumping like altcoins, but it’s also not mooning.

- People might be rotating into ETH instead of going risk-on with smaller alts.

- But let’s be real—ETH needs a catalyst to break out of this boring range.

Altcoin Graveyard—Except for One Token

- 🔻 XRP (-2.30%) and SOL (-3.99%) are bleeding out, just following BTC’s lead.

- 🟢 XCN (+11.73%) is the ONLY bright spot—which usually means a pump-and-dump could be in play.

When one random token is pumping while everything else is down, I always ask: who’s pushing this? Market manipulation? Speculative breakout? Either way, be careful.

The Big Takeaway—What This Means for Your Bags

- The market is in a wait-and-see mode. Big traders are chilling in USDT instead of aping into alts.

- BTC is struggling to hold momentum. The trend is still downward-sloping, and without new buyers, we’ll keep grinding lower.

- Alts are weak AF. If Bitcoin isn’t strong, alts don’t stand a chance.

- XCN might be the short-term play. But watch out for rug-pull vibes.

Final Question: Cut Your Losses or Ride It Out?

Let’s get real for a second. If you’re sitting on a losing position, ask yourself:

- Can you mentally and financially tolerate more downside?

- Are you holding on just to avoid realizing a loss, even if the trend is against you?

- Would it be smarter to sell now, protect capital, and reallocate when the market shows strength again?

Why I Recommend Coinbase One for Trading

When it comes to trading crypto, having a reliable and secure exchange is crucial. That’s why I personally use and recommend Coinbase One—a premium membership that comes with some awesome perks, including:

- 💰 4.5% APY on USDC – Earn higher interest on your stablecoins.

- ⚡ Zero trading fees – Save on fees when making high-volume trades.

- 🔹 25% off spot fees with Coinbase Advanced – A great deal for active traders.

- 🚀 Boosted staking rewards – Earn up to 17.25% APY on staked assets.

- ⛽ Free gas on Base – Get a $10 USDC monthly rebate for transactions on Coinbase’s Base network.

- 📊 Analytics via Messari – Access premium crypto research with a 90-day free trial.

- 💳 Exclusive tax benefits – Partnered tax solutions to help you optimize your crypto gains.

Whether you’re actively trading or just looking for a way to maximize your holdings, Coinbase One offers serious value. If you’re interested, check it out here:

Join Coinbase One and start saving today!

Give it a try and see if it fits your trading needs—because in this market, every advantage counts!

Leave a comment